This intro post is brought to you by BusyKid.com!

When you were in high school, you probably thought about how some of the classes you’re taking will ever help you in life after you graduate.

Chances are, many high school students these days are also asking themselves the same question. Unless they’re planning on becoming engineers, scientists, or history or English teachers, they’re probably wondering if they will ever get to use all those equations, sonnets, and knowledge of historical events when they’re finally leading independent, adult lives.

How to Help Your Child with Financial Literacy

It’s just frustrating that the school system is preparing our children for just about everything except for the one that matters most: how to manage their finances.

There may be some exceptions, but most schools never teach our kids financial literacy. Whether they become engineers, scientists, or English teachers in the future, they still would need to learn at least the fundamentals of money management to succeed in life.

While the hard sciences, social sciences, art, and literature they teach in schools are key to a well-rounded education, a little more attention to financial literacy will make them even more prepared for life after school. Knowing how to budget, save, invest, give, and handle debt is an essential skill for everyone, regardless of age, career path, and educational accomplishments.

Thankfully, more and more people are becoming aware of this missing piece in our educational system. Many parents are now taking it upon themselves to teach children what they know about money management. They do things like paying their kids an allowance for completing chores. Many even take it a step further by using a chore app for kids to teach their children financial literacy.

Final Thoughts

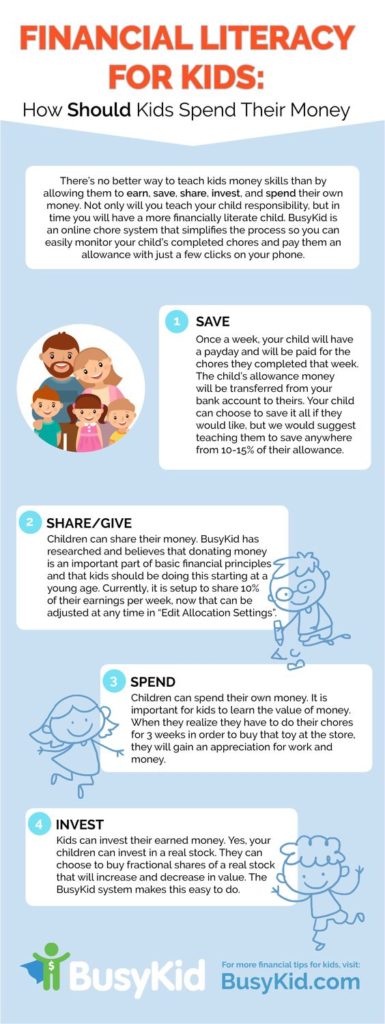

There’s still hope that the educational system will one day make money management classes mandatory. Until then, parents will have to pick up the slack. If you’re one of those parents, check out the infographic below to help you get started on financial literacy for kids.

Please comment below for ways on how you are starting financial literacy with your kids!